Retirement is a phase in life that a lot of working people look forward to. Being able to plan for it is a huge help for anyone who’s expecting to retire real soon. But, retiring requires an individual to have sufficient income to support themselves (Dan, 2004). Below are retirement statistics to consider and understand in order to have a better retirement plan.

Average Retirement Savings Statistics

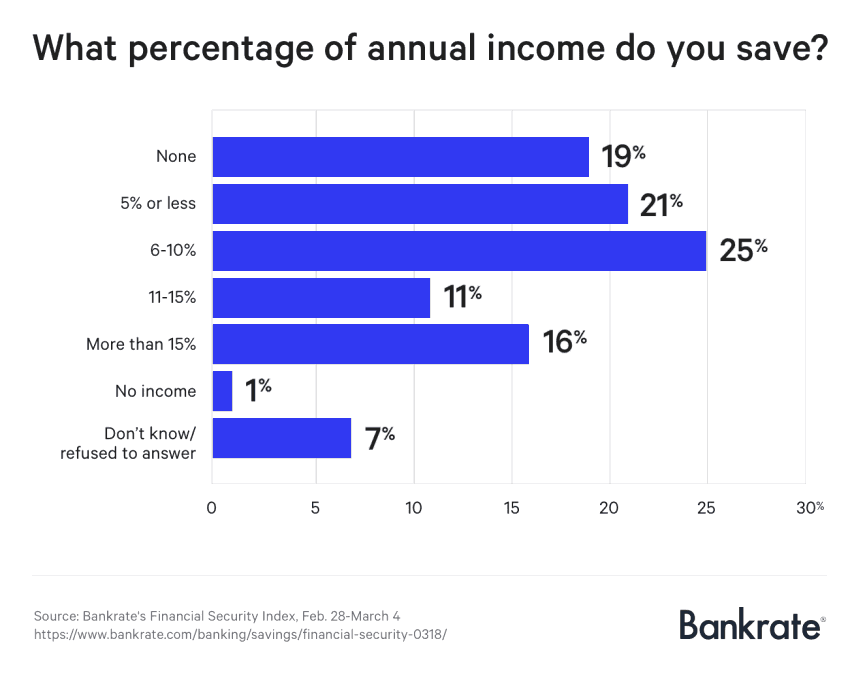

Economists say that people, on average, are not saving enough in preparation for their retirement (Dan, 2004). Bankrate’s Financial Security Index conducted a survey in America in 2018 regarding the percentage of annual income an individual saves for retirement.

Even with the low unemployment rate, as observed in the graph, the ones who do have an income are not saving much. A considerable percentage of 19% said that they are not even saving any of their annual income, and only 16% said that they could save more than 15% of their annual income. Bankrate said that if this is the case, then individuals could fall short during their retirement. A senior economic analyst from Bankrate even called this a “financial fail.”

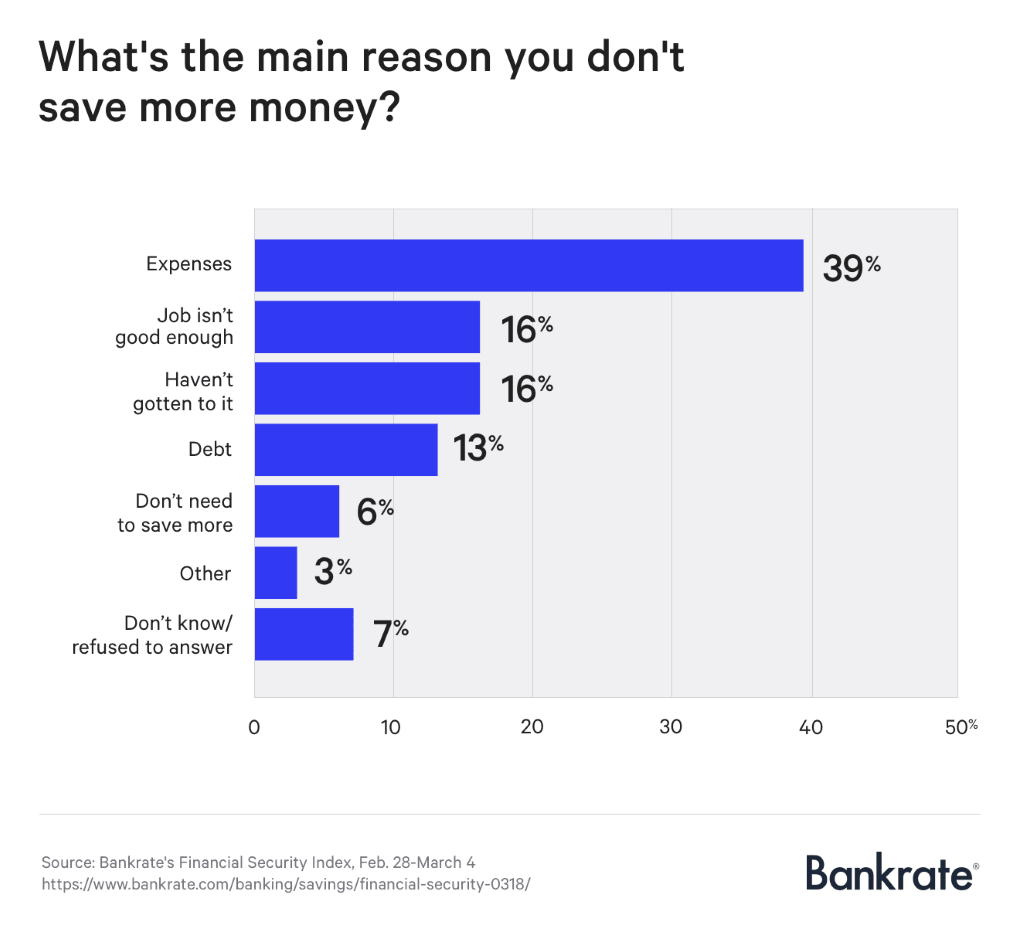

In the same survey, 39% of the respondents said that they are not able to save more money because of expenses. 16% said that their job is not enough, and another 16% said that they haven’t gotten to it yet.

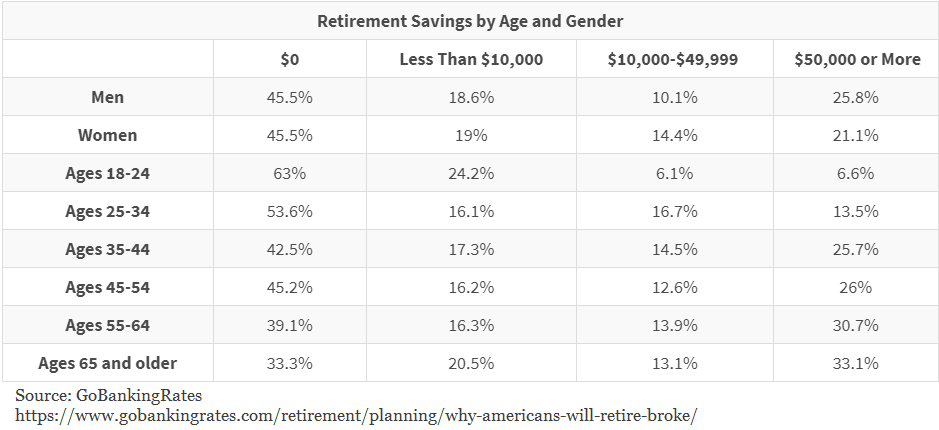

GoBankingRates conducted a similar survey, and almost half of their respondents – 45% – said that they had no money saved for retirement. Around 33% of the individuals who responded that they had no money saved for retirement belong in the age bracket of 65 and older. This is quite interesting because they are already in the typical age for retirement. Yet, they have no savings for it.

Around 19% answered that they would be retiring with less than $10,000, 12.3% said that they would be facing retirement with $10,000 – $49,999 under their name, and only 3.9% claimed that they would retire with $500,000 or more. 25.8% of the 3.9% of respondents are male.

In the same survey, individuals were asked why they do not have any retirement savings. Almost half of the respondents, again, – 45% – said that they do not make enough money to save, 24.4% said that they are struggling with bills. That is why they do not have any retirement savings, and 9.2% said that they would not need to save for retirement anyway.

Three of the common reasons for individuals not being able to save up enough money for retirement are:

- “I don’t make enough money to save” (40.1%)

- “I’m struggling to cover my bills (mortgage, rent)” (24.9%)

- “I’m prioritizing erasing my debt” (5.7%)

Many experts used to recommend 1 million dollars of retirement savings. Still, even Mark Avallone, president of Potomac Wealth Advisors and author of “Countdown to Financial Freedom,” says otherwise. He said that if a 67-year-old baby boomer has $1 million in his bank account, he will have to live on $40,000 a year adjusted to inflation. Now, American author and financial advisor, Suze Orman suggests that you should have a minimum of $5 million, so you can retire at the age of 70.

According to Fidelity’s rule of thumb, you should have a goal. Save at least one time your salary at age 30, 3 times your salary at age 40, 6 times your salary at age 50, 8 times your salary at age 60 and 10 times your salary at age 67.

Even with the varying suggestions of experts, one thing is for sure – you must consider the age you wish to retire, and the lifestyle you hope to have during retirement. This is necessary to prepare for your retirement savings properly.

Baby Boomers Retiring Statistics

Baby Boomers are born between the early to mid-1940s to 1960-1964. These are the people who struggled in the transition of a pension to a 401k. There was no easy way to gather information on how to prepare for retirement, and during their time, knowing about index funds was a privilege.

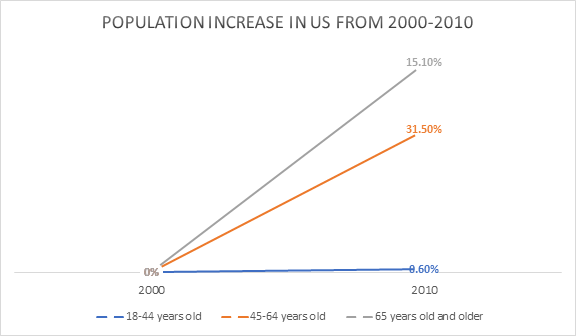

Baby boomers, at present, are aging the world’s population. In America alone, there was a 31.5% increase in population that belongs in the age bracket of 46-64 during 2000-2010.

AARP surveyed 1,200 respondents on the retirement expectations of baby boomers. The key findings of the survey are:

- Baby boomers are now more knowledgeable about Social Security than five years ago.

- Baby boomers are now more confident that Medicare will be available when they turn 65 than five years ago.

- Baby boomers have a more conservative yet still optimistic retirement expectation now than five years ago.

- Baby boomers retain their definition of retirement as it was in 1998 – an opportunity to spend quality time with family, find hobbies, and enjoy leisure time.

Even with these positive results of the AARP survey. The American College of Financial Services still concluded that baby boomers are not knowledgeable enough about Social Security, investments, and long-term care.

This information was gathered through the 2017 Retirement Income Literacy Survey, which focused on the age bracket of 65-70 with at least $100,000 in household assets and investable assets. The key findings of the survey are:

- Retirement literacy is low. Only 26% passed the 38-item retirement literacy quiz.

- Only 5% of the total respondents scored 80% or higher.

- The average score is 47%.

- Respondents have a lack of knowledge in preserving assets as well as sustaining an income in retirement.

- Only 38% of the baby boomer respondents know that in order to live off their retirement with a $100,000 retirement savings, the safe withdrawal is $4,000 per year only. This reflects their lack of knowledge in an effective withdrawal retirement rate.

- Only 34% of the baby boomer respondents know that a substantial negative investment return before or after retirement age has a lesser impact on portfolio sustainability than having the same substantial negative investment at retirement age.

- Around 50% of the baby boomer respondents underestimate the life expectancy of their assets and the life expectancy of a 65-year-old man.

- Respondents have a lack of knowledge regarding ways to improve retirement security.

- Only 33% understand that it is less effective to increase contributions by 3% for five years before the planned retirement age than working two years longer or deferring Social Security for two years.

- Less than 50% of the baby boomer respondents know that in order for an individual to be protected against unexpected situations, a portion of the portfolio should be used to purchase a life annuity.

- Individuals belonging to the older age bracket show a more significant lack of knowledge and understanding regarding annuities, investments, claiming Social Security, and long-term care compared to individuals belonging to the younger age bracket.

- Over 57% of the baby boomer respondents answered the three annuity questions incorrectly.

- Only a ratio of 1 out of 3 understands the value of bonds and bond funds.

- Only a ratio of 1 out of 10 knows that small-company stock funds yield higher returns than large company stock funds.

- Around 59% of the baby boomer respondents know that the benefits of Social Security increase each year if claiming it will be delayed until the age of 70. Even with a relatively better result, it still poses great concern because of the vital role Social Security plays in retirement.

- Only a ratio of 1 out of 3 knows that Medicaid pays for most of the long-term care expenses in homes for the aged.

- Only 30% of the baby boomer respondents know that family members give the majority of long-term care services.

- 82% believe that there are lesser individuals who need long-term care.

- Individuals belonging to the generation of baby boomers appear to be more knowledgeable and with a better understanding of inflation.

- 88% of the baby boomer respondents understand that inflation reduces buying power.

- 59% of the baby boomer respondents know that the best way to protect against inflation is a diversified portfolio of stocks.

- Only 34% had a formal written retirement plan, and 66% did not have a formal written retirement plan.

- Only 36% had a long-term care plan, and 64% did not have long-term care plans.

Thousands of baby boomers retire every day, and the findings, as mentioned earlier, pose a significant concern. It can be quickly concluded that baby boomers are not prepared enough for the coming of their retirement.

Retirement Income Statistics

Retirement income includes all the money an individual earns after retiring. These are Social Security allowances, pensions, stocks, mutual funds, savings accounts, annuities, insurance, royalties, inheritance, and more.

Social Security remains one of the most critical programs for the retired workforce. Pensions are vital to retirement security. Social Security can only provide a safety net.

- By 2017, 61 million people were receiving benefits. 41.51 million of the beneficiaries are retired workers.

- To qualify for Social Security upon retirement, an individual must have collected 40-lifetime work credits. A maximum of 4 credits can be given per year. It means that an individual must be working for at least ten years. Work credit is earned in pair with inflation. In 2017, an individual can earn four work credits if $5,200 is earned in income.

- Social Security pays retired workers an average of $1,469.52 monthly and an average of $17,634.24 per year.

- Between 2010 and 2030, the percent of the gross domestic product spent on Social Security will increase by about one-third, from 4.8% to 6.4% (Binstock, 1998). According to the Social Security Administration, it is not projected to be sustained under the existing system because of insufficient funds.

- Retirees that have pensions have more significant income security. The average private pension is $9,376 per year.

- There are 31% of older individuals with a pension.

- Pensions remain to be the world’s largest source of capital, with a value of $22.7 trillion.

- Not every employer offers a retirement plan like the 401k. A study by the National Institute on Retirement Security found that only 40% of the individuals provided with a 401k type of retirement plan participate.

Retirement Savings Statistics

In terms of savings, the Pension Rights Center collected data and statistics regarding the value of pensions. It states there that most retirees have little in personal savings.

- The savings of older households total an average of $59,500.

- The average income from older individuals’ savings is around $1,754.

- The average income of older individuals is $23,394.

Social Security is projected to run out of money by 2030 to 2070. (Mitchell, 1996; Richards, 1997) This pushes for the necessity to save for retirement because the life expectancy of Social Security is not assured.

In 2019, it was discovered that 21% of Americans have little to no retirement savings in their banks. The Economic Policy Institute found that the retirement savings problem is worse for millennials. Six out of ten individuals have no retirement savings at all. It is more than half the millennial population.

Retirement Crisis Statistics

Forbes, CNBC, and numerous news outlets have released the retirement crisis we are facing.

According to a report by the Wall Street Journal, around 10,000 baby boomers turn 65 every day. They’re reaching this age in the worse financial state than the previous generation.

One out of five individuals has nothing saved for retirement or emergencies. The data collected by the BankRate and GoBankingRates surveys are enough to indicate a colossal retirement crisis.

Even with private savings, Social Security, and pensions, individuals will still be faced with a retirement crisis.

The average 401k value adjusted with inflation is $58,035. If an individual plans to retire at the age of 65 and expect to live until 85, then every year, it is around $2,901.75. Social Security pays an average of $17,634.24 per year.

Private pensions pay an average of $9,376 per year. If we add the pension, social security, and personal savings, the total retirement income is $29,911.99 per year.

An individual can barely get through 12 months of living expenses and probable emergency expenses with $29,911.99. A maximum of $2,492.67 per month is the standard expense to make it through the year safely. This will put individuals into a retirement crisis if retirement plans are not adequately done beforehand.

Average Retiree Net Worth Statistics

According to the Health and Retirement Survey in the late 1990s, more than 50% of households have less than $6,000 in financial wealth, and 25% of households have less than $30,000 in total net worth by the age of 51-61. The same survey discovered that the respondents are coming into the age of retirement, with only a net worth of $100,000 – $110,000.

According to Wolff in 2000, rich people experience a 17% growth in their net worth as they retire while 95% of the population who are not on the wealthy side experience a decline in net worth as they retire.

Housing wealth can be a significant contributor to total net worth (Wakita et al. 2000), and better net worth is a huge source of retirement income. Housing wealth constitutes most of the total net worth of the lesser wealthy percentage of the population. It can reach up to 73% of their total net worth. The wealthy people only have a small housing wealth percentage of 6%, constituting their total net worth.

Age is closely related to the total net worth because wealth grows over time. The oldest cohort can generate more significant asset accumulation. The youngest cohorts, however, creates greater expected reliance on their savings or personal assets because the reliance on Social Security is unsure.

Marriage also enhances total net worth because of the pooled resources and economies. Married individuals, therefore, have more likely better financial resources and stability for their retirement needs. However, the more children in a household, the more the savings and total net worth will decrease.

Over time, there is an increase in the average net worth of retirees. In 1989, the average net worth of retirees was $509,000, while in 2001 it was $782,000. In 2016, the average retiree net worth reached more than $1 million.

Resources:

Dan, A.A. (2004). What are People Doing to Prepare for Retirement? Structural, Personal, Work, and Family Predictors of Planning. Retrieved from https://etd.ohiolink.edu/!etd.send_file?accession=case1079241195&disposition=inline

Johnstone, A. (2019). GEN WHEN? Who are Millennials, Baby Boomers, and Generation Z? Generation groups explained. Retrieved from https://www.thesun.co.uk/fabulous/5505402/millennials-baby-boomers-generation-groups-z-y-x-explained/

ASW, R., Zapolsky S. (2004). Baby Boomers Envision Retirement II: Survey of Baby Boomers’ Expectations for Retirement. AARP Knowledge Management. AARP Research. Retrieved from https://www.aarp.org/work/retirement-planning/info-2004/aresearch-import-865.html

Hopkins, J., Littell, D. (2017). 2017 RICP® Retirement Income Literacy Survey. American College, New York Life Center for Retirement Income. Retrieved from http://retirement.theamericancollege.edu/sites/retirement/files/2017_Retirement_Income_Literacy_Report.pdf

Retrieved from http://www.pensionrights.org/publications/statistic/why-pensions-are-important-sources#socialsecurity

Orzechowski, S. & Sepielli, P. (May 2003). Net worth and asset ownership of households: 1998 and 2000. Household Economic Studies. A report issued by the U.S. Census Bureau: Washington DC.

Wakita, S., Fitzsimmons, V.S., & Liao, T.F. (2000). Wealth: Determinants of savings net worth and housing net worth of pre-retired households. Journal of Family and Economic Issues, 21(4), 387-418.

Leave a Reply